Can you afford to wait to review your insurance?

There have been some significant changes in the insurance industry that may affect you, especially concerning income protection insurance.

If you haven’t had the opportunity to review your situation for some time, and your circumstances may have changed, now may be the time to take action to ensure your financial well-being and security.

We’re excited to inform you that over the past few years, we’ve developed an insurance review process aimed at helping you navigate these changes effectively. Here’s a brief overview of what it entails:

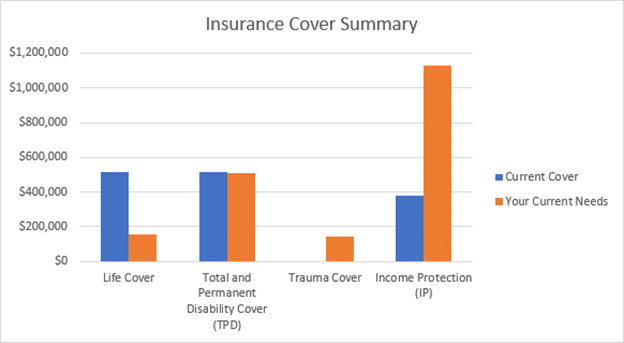

1. Identifying insurance needs: We conduct a thorough needs analysis to assess your current levels of insurance coverage against what you may need. This includes graphing your existing coverage to provide a clear visual representation of any gaps or overinsurance.

2. Comparison Table: We then create a matrix table that outlines your current cover with the different options available to adjust your coverage levels to meet your needs. This includes associated costings and any feature and benefit trade-offs to help you make informed decisions about your options.

3. Pre-Assessments and Application Support: We can complete pre-assessments with insurance companies to identify any potential issues with a new application. Our team will guide you through the application process, ensuring a smooth experience from start to finish.

Click here for some more information about income protection insurance

We understand that navigating insurance decisions can be complex, which is why we’re here to support you every step of the way. Additionally, we can help you understand the long-term premium impact of your insurance decisions, particularly for your super savings.

Should you wish to explore our insurance review process or have any questions about the recent changes in the insurance industry, please don’t hesitate to reach out to us. We’re here to assist you in any way we can.

P: (02) 9145 9019

E ryanadmin@everydaywealth.net.au